- August 31, 2024

- Posted by: papasiddhi

- Category: Innovation

The Future of Carbon Credits: How Climate Change Is Transforming Global Markets and the Journey to Becoming a Zero-Carbon Enterprise

As climate change worsens, carbon credits have become a key way for organizations and countries to reach net zero. As the world focuses more on reducing carbon emissions, carbon credits are moving from a small market to an important part of the global economy.

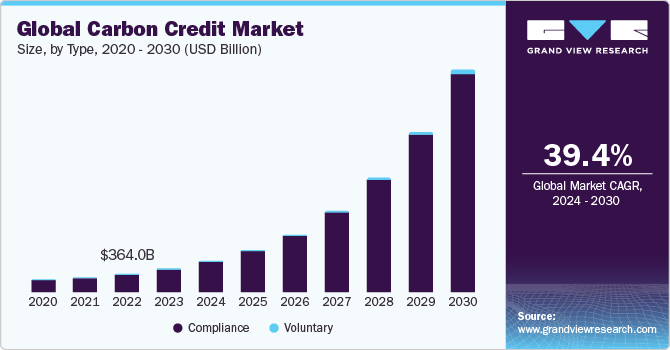

The Growth of Carbon Markets

Over the past decade, carbon markets dealing with carbon credits have expanded significantly. Credits originating from the Kyoto Protocol and the CDM now play a central role in corporate climate action. However, they remain a complex commodity. Currently, two main types exist: compliance carbon markets (CCMs) and voluntary carbon markets (VCMs). CCMs are policy-driven and pertain to the regulation of emissions, while VCMs offer a platform for corporations and individuals aiming to reduce their carbon footprint.

Compliance markets cater to entities with legally binding emissions targets, while VCMs provide flexibility for those seeking to minimize their carbon footprint. Both markets face challenges, including fragmentation, credibility issues, and inconsistent regulations across different jurisdictions. Addressing these challenges is essential for carbon credits to significantly contribute to global decarbonization efforts.

Carbon Credits and the Path to Net-Zero: Insights and Challenges

The push for net-zero emissions has heightened the importance of carbon credits, particularly for industries struggling to eliminate emissions.

– Net-Zero Imperative: The global drive towards net-zero emissions by 2050 has made carbon credits a vital tool in the decarbonization process, especially for industries with hard-to-abate emissions.

– Crucial for High-Emission Sectors: Carbon credits are essential for sectors like manufacturing and transportation, enabling companies to offset emissions that cannot be eliminated through operational improvements.

– Emissions Offsetting: Carbon credits can be effectively used to finance projects like reforestation, renewable energy, and carbon capture and storage, helping to neutralize remaining emissions.

– Quality and Integrity: High-quality carbon credits are essential for funding real climate action. It is crucial that these credits represent genuine, additional, and credible emission reductions.

– Greenwashing Risks: Some businesses purchase low-quality credits to appear aligned with climate targets, a practice known as ‘greenwashing.’ To avoid market fraud, it is vital to ensure that the carbon credits bought genuinely contribute to emission reductions and support global net-zero objectives.

Scaling Voluntary Carbon Markets

To meet their potential, VCMs must evolve. This includes enhancing the quality and transparency of carbon credits, increasing the availability of high-quality removal credits, and aligning compliance and voluntary markets.

Reforms are already underway, with initiatives like the Paris Agreement Amendment introduced at COP26, which seeks to harmonize the global carbon market by regulating the accounting and transfer of carbon credits across nations. This framework, embedded in Article 6, could enhance the credibility of VCMs and encourage broader participation from companies.

The voluntary carbon market faced significant challenges in 2023. According to BloombergNEF’s 2024 report, 2024 could be a pivotal year: restoring confidence could drive carbon credit prices above $200 per ton and create a $1.1 trillion market by 2050. Conversely, failure could result in the market’s collapse.

Challenges and Opportunities in Carbon Markets

Carbon markets are evolving, presenting both challenges and opportunities for addressing climate change and shaping business strategies.

Challenges:

- Regional Fragmentation: Carbon markets are predominantly regulated by individual nations, lacking global standards or a unified market. This fragmentation can undermine the effectiveness of carbon markets in tackling global emissions.

- Complex Voluntary Market: The fragmented nature of the VCM, with numerous actors and standards, makes it difficult for companies to trust and integrate these credits into their net-zero strategies.

Challenges in Carbon Markets

- Lack of Transparency:: The demand for greater transparency and the establishment of global standards in carbon markets is growing. Without these, the effectiveness of carbon credits in contributing to genuine emission reductions remains questionable, and confidence in the market is at risk.

- Trust Deficit: Despite global initiatives like the Integrity Council for the Voluntary Carbon Market working to enhance the credibility of carbon credits, the current lack of trust poses a significant challenge. Companies may struggle to confidently integrate these credits into their decarbonisation strategies without assurances of their legitimacy and impact.

The Road to Becoming a Zero-Carbon Enterprise

The Road to Becoming a Zero-Carbon Enterprise

For businesses aspiring to achieve net-zero emissions, carbon credits are a key component of a broader environmental management strategy. However, they should not be viewed as a means to avoid making direct emission reductions. Companies must strive to minimize their emissions as much as possible and use carbon credits to balance out any remaining emissions.

Additionally, businesses should ensure that the carbon credits they purchase contribute to long-term climate solutions. Tools like the Business Carbon Emissions Calculator can assist organizations in calculating their carbon footprint, identifying areas for emission reductions, and purchasing high-quality carbon credits. These tools are instrumental in helping companies develop and implement credible low-net-zero strategies that align with global climate goals.

The Future of Carbon Credits

– Enhanced Market Integrity: Future trends in carbon credits are expected to focus on improving market transparency and credibility, which will be essential for preventing fraud and ensuring accurate accounting as the market expands.

– Scaling Up High-Quality Projects: As demand for carbon credits grows, there will be an increasing emphasis on scaling solutions that effectively reduce atmospheric carbon, with technological advancements and robust project management playing a crucial role.

– Integration with Global Climate Policies: Carbon markets are likely to become more closely aligned with international climate agreements, helping to standardize carbon credit trading and strengthen its role in global climate strategies.

– Growing Demand and Innovation: As climate change intensifies, the demand for carbon credits will increase, leading to the creation of new credit activities and trading opportunities for businesses.

– Strategic Business Engagement: Companies must enhance their carbon management processes and engage with the evolving carbon market to meet their sustainability goals and contribute to global climate objectives.

Conclusion

On the journey to becoming a zero-carbon enterprise, carbon credits and markets are vital tools that enable businesses to contribute to the global effort against climate change. By utilizing tools like the Business Carbon Emissions Calculator and actively participating in legitimate carbon markets, companies can not only offset their emissions but also drive innovation and leadership in the fight against climate change.

Leave a Reply

You must be logged in to post a comment.